US Senate subcommittee on DPRK; Mooncakes confiscated on NK border; Iran taking part in constructing oil refinery in Syria; Iranian trade increased over last six months

Prohibited Transactions for the week of 2 Oct 2023 (#22)

North Korea

A US Senate subcommittee held a hearing on “Security on the Korean Peninsula,” and invited three North Korea experts to testify.

The first expert stated that Kim Jong-un’s recent summit with Vladimir Putin could result in “significant Russian support of North Korea’s weapons programs,” as it’s unlikely that Kim would have traveled to Russia simply for a food-for-munitions deal.

The expert suggested the US pursue a course of “censure and sanctions” through the G7-plus and NATO + Asia-Pacific 4, as the PRC and Russia would block any actions via the UN Security Council.

A second expert noted that Kim’s turn to Russia indicates that the DRPK is no longer pursuing a “sanctions-relieving deal” with Washington, and is instead looking for a “sanctions-defying arms deal” with Moscow. And an unintended consequence of sanctions against Russia for its invasion of Ukraine was a lessening of Pyongyang’s isolation, because now there is another country facing large scale sanctions that North Korea can do business with.

The second expert suggested the US pursue a broad multilateral sanctions regime with like-minded nations, similar to the Proliferation Security Initiative (PSI) which was a multilateral effort to interdict illicit North Korean commercial transfers.

A third expert noted that North Korea continues to adapt to the sanctions and restrictions placed on it and therefore the regime doesn’t have to choose between denuclearization and survival. //These types of hearings can seem far removed from the daily work of compliance professionals, but these policy dialogues are where government sanctions policies are born, ones that financial institutions will eventually have to adhere to. And it’s not just banks following along; North Korean officials also have a vested interest in knowing what direction US policies are moving, so that they can strengthen their sanctions evasion efforts.

According to US media, Pyongyang has begun to transfer artillery to Moscow. It is unclear if this is a one-off transfer, or part of a longer-term agreement.

A North Korean vessel, the Mu Bong 1 — known to have engaged in illicit ship-to-ship (STS) transfers in the past — has been spotted off the coast of a Chinese port.

North Korean workers and traders in Dandong, China, are still waiting for the border to reopen. //I’m a bit confused because, as discussed in Issue #17, the border between the PRC and DPRK is opened and there has been documented movement — including from covert reporting done in North Korea — that people are returning home and trade is picking up.

North Korean trade officials visiting home from China for Chuseok, the mid-autumn harvest festival, are having their mooncakes confiscated by border guards, as it is not considered a traditional Korean food. //Guess mooncakes will not have the opportunity to be traded like Choco Pies.

Illicit North Korean exporters are having troubles selling seafood on the Chinese black market, due to lessening Chinese demand following the release of radioactive water from Fukushima.

Iran

Ninety percent of trade between Iran and Russia is settled via the national currencies — the rial and the ruble — of the two countries, in a concerted attempt to avoid using US dollars. Additionally, a “secure channel” to exchange financial information between the two countries has been established. //Not really sure what this secure channel means, but it stands as a sign of increased cooperation between the two sides.

Iran, Venezuela, and Syria agreed to construct a new oil refinery in Syria’s Homs Province. The refinery would process oil provided by Iran and Venezuela. Separately, Tehran and Damascus signed a memorandum of understanding regarding the repair of another refinery also located in Homs.

Over the past five months, there was an 87 percent increase in the transit of goods through the western province of Kermanshah, and a 37 percent increase of exports from the northeastern province of Golestan over the last six months. For Iran as a whole, there has been a 5.4 percent increase in the transit of goods during the last five months. Iranian cargo transit is up 8.2 percent between March and September 2023, compared with the same period last year. Iranian media noted that the country’s domestic fleet of rail cars will be growing this year, and that Iranian and Russian companies are looking to increase railway cooperation. //All this to say that Iran’s transit potential continues to grow and Tehran appears to actively looking to cement its role as a transit crossroads (e.g., A Russian cargo train has arrived in Bandar Abbas with goods that will be transshipped via ocean vessels to Saudi Arabia).

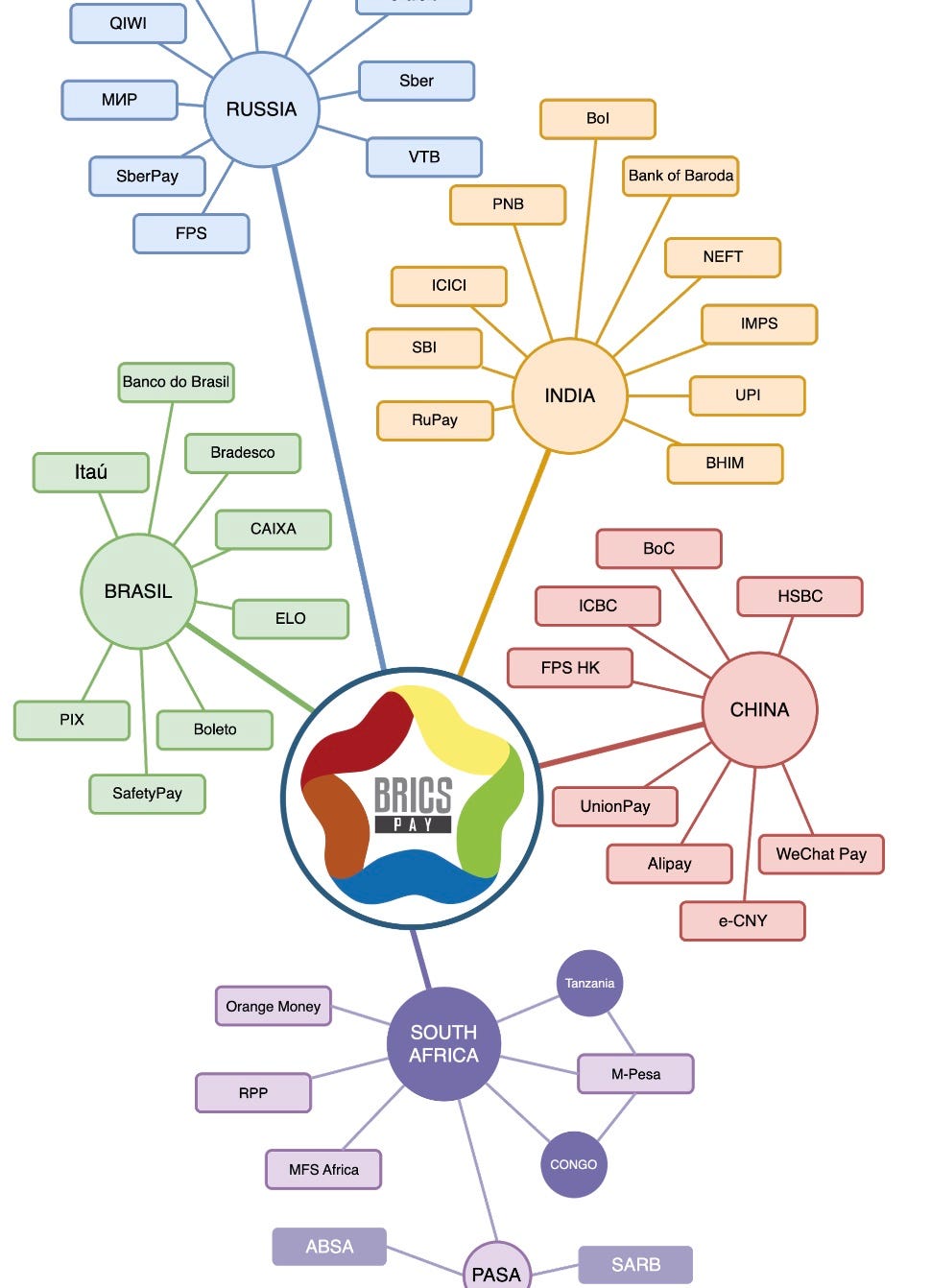

Iranian media is reporting that the BRICS group of nations is considering setting up an alternative to the SWIFT global payment messaging system. Iran’s parliament speaker noted that if a separate system could come to fruition, it would help mitigate Western sanctions against Iran. //How long would it take to really take to get up and running a working alternative to the SWIFT system? Would be BRICS system use US dollars, the currencies of BRICS members, or a BRICS common currency? A different article in Iranian media highlighted that BRICS already has an alternative system, BRICS PAY, which at least according to their website appears to be an effort spearheaded by individuals within BRICS member nations, but not necessarily their governments.